As parents, we always want to do what is best for our children, but the question of are you saving enough for your child is one that always leaves me in two minds. I would love to be able to say that we are constantly saving for the boys, but at the moment, that isn’t strictly true.

Part of me feels that the husbeast and I managed without very much input from our parents, but also a big part of me want to give them more than I had. Plus homes are costing more and more as the years go on. Also, we might want to help them with the cost of education and university.

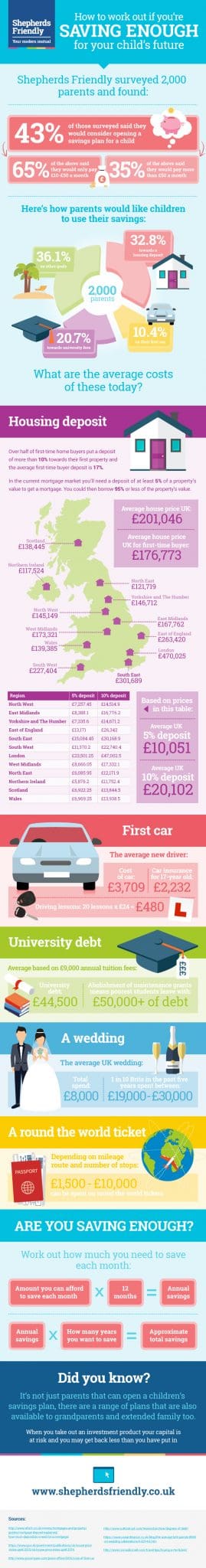

But how do you work out if you are saving enough for your child’s future? Well Shepherds Friendly have produced this infographic to help you work it out.

Unfortunately, both of my boys fall into the tiny timescale of child trust funds, but if you have children under 18 that do not have child trust funds then you might want to consider a Junior ISA (you can transfer your child trust fund to a Junior ISA too).

You can open a Junior ISA with a deposit of £100 and then a monthly minimum payment of £10. Plus the contribution doesn’t have to be from you, if can be from anyone,making it perfect for relatives to add to for Christmas and birthdays.

So what is an ISA?

An ISA is a savings accounts where the interest isn’t taxed.

People often think that isa’s are only for people with money and that they are not something that they can utilise to manage their finances, but again it is often about working smarter not harder and in today’s climate we need to know the best way of making our money work for us.

But don’t take my word for it, go and see a professional!

Comments are closed.